SIP, STP, SWT - Arethra Wealth

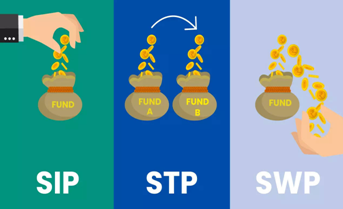

SIP, STP & SWP: Smarter Strategies for Every Stage of Your Investment Journey

At Arethra Wealth, we believe wealth creation and wealth management require more than just good intentions — they require structured strategies. Whether you're just beginning to invest, reallocating funds, or looking for a steady income stream, SIP, STP, and SWP are essential tools in building a strong, flexible, and goal-driven financial plan.

What is an SIP (Systematic Investment Plan)?

A Systematic Investment Plan (SIP) allows you to invest a fixed amount at regular intervals — typically monthly — into mutual funds. It helps you develop a habit of disciplined investing, making market fluctuations work in your favor through rupee cost averaging and the power of compounding.

Key Benefits:

- Ideal for long-term wealth creation

- Reduces the risk of market timing

- Flexible and easy to start with small amounts

- Perfect for goals like retirement, children's education, or home purchase

What is an STP (Systematic Transfer Plan)?

A Systematic Transfer Plan (STP) allows you to transfer a fixed amount from one mutual fund to another — usually from a debt fund to an equity fund — at regular intervals. This is ideal when you've invested a lump sum but want to avoid market volatility by gradually entering equity markets.

Key Benefits:

- Manages risk during market entry

- Keeps funds productive while waiting to invest

- Useful for staggered investments from lump sum capital

- Offers flexibility to adjust amounts and frequency

What is an SWP (Systematic Withdrawal Plan)?

A Systematic Withdrawal Plan (SWP) is designed for investors who want regular income from their investments. It allows you to withdraw a fixed amount at set intervals — monthly, quarterly, etc. — while the rest of your investment remains invested and continues to grow.

Key Benefits:

- Steady cash flow for retirees or income-seeking investors

- Tax-efficient compared to traditional interest income

- Customizable based on your income needs

- Avoids panic selling during market dips

SIP, STP, SWP — Which One Is Right for You?

At Arethra Wealth, we evaluate your current financial situation, risk tolerance, and life goals to recommend the right mix of SIP, STP, and SWP strategies. Whether you're just starting out, planning a major investment move, or preparing for retirement, we tailor solutions that grow, protect, and distribute your wealth — efficiently and effectively.

Why Choose Us for SIP, STP & SWP Planning?

- ✅ Personalized, goal-oriented planning

- ✅ Regular portfolio reviews and rebalancing

- ✅ Tax-efficient investment strategies

- ✅ Trusted advisory with a fiduciary-first approach

Start Investing Smarter Today

Whether you’re investing for growth, transitioning funds, or planning withdrawals, we’ll help you make the most of SIP, STP, and SWP strategies.

Book your free consultation

today and let’s build a structured investment plan that supports your life goals — at every stage.

Call us at +91 70780 58489

Email us at arethra.wealth@gmail.com